What Is an Employer of Record (EOR)? Weighing the Pros and Cons

AUTHOR

Talent JDI

READ TIMES

1 minutes

LAST UPDATED

Jan 30, 2026

In today’s fast-paced business landscape, where efficiency and cost-effectiveness are paramount, Employer of Record (EOR) services have become the go-to solution for companies looking to easily build and manage offshore teams in Vietnam.

However, many are still unfamiliar with the concept of an Employer of Record (EOR) or uncertain if it could benefit them as it has for others. This article will explore the advantages of using an EOR and highlight key factors businesses should consider before taking the leap.

What Is Employer of Record (EOR)?

An Employer of Record (EOR) is a trusted partner that takes care of all administrative and legal details of employment—such as onboarding, payroll, benefits, and legal compliance—so businesses can hire and manage their teams hassle-free.

Thus, an EOR is especially beneficial for companies struggling to hire offshore developers and build remote teams in Vietnam due to legal, administrative, and cultural barriers. In other words, they help companies maintain offshore teams without the need for additional HR staff, allowing them to focus on what truly matters—growing their core business.

Employer Of Record Vs. PEO – What’s The Difference?

If you’re exploring Employer of Record (EOR) services, you’ll likely come across another option: the Professional Employer Organization (PEO). While both fall under employment services, they differ in their approach to employer responsibilities.

A PEO operates under a co-employment model, assisting with administrative tasks but leaving legal responsibility and day-to-day control to the client. Engaging a PEO to build an offshore team requires setting up a legal entity in Vietnam first.

In contrast, an EOR serves as the legal employer for your team, handling compliance and employment matters while you maintain operational control. An EOR becomes an ideal choice when an entity has not yet been established in Vietnam, allowing you to focus on scaling your team and business seamlessly.

There are also other differences in the scope of services offered and how they operate:

Employer of Record (EOR) | Professional Employer Organization (PEO) |

|

|

In summary, while both EORs and PEOs offer valuable solutions for client employment management needs, the EOR model involves the provider becoming the legal employer, while the PEO model involves a shared employer relationship. EORs specialize in global employment solutions, while PEOs provide comprehensive HR services within a specific country.

For broader insights: The Complete Guide To Outsourcing HR

How an EOR Can Benefit Businesses

Employment Contract Management

EORs help handle every step of employment contracts—from drafting and negotiating terms to ensuring legal compliance. They manage contract administration, amendments, and terminations, lifting the administrative load off clients while ensuring contracts align with local employment laws.

Payroll Processing

EORs calculate salaries, deductions, and tax withholdings, ensuring full compliance with local tax regulations. By streamlining payroll, they help businesses ensure employees are paid accurately and on time.

Benefits Administration

EORs assist with employee benefits, such as health insurance, retirement plans, and other statutory benefits. They oversee benefits enrollment, administration, and regulatory compliance, giving employees access to comprehensive benefits packages tailored to local standards.

Taxation and Compliance

Navigating complex tax laws, EORs handle payroll taxes, social security contributions, and employment-related taxes. By staying updated on regulatory changes, they minimize the client’s risk of penalties and ensure seamless tax compliance.

HR Administration

EORs support HR tasks like onboarding, offboarding, and maintaining personnel records. They can assist with time tracking, leave management, and performance evaluations, keeping HR operations efficient and smooth.

Legal Compliance

EORs stay up-to-date with local labor laws, employment regulations, and statutory requirements to ensure client compliance. They offer expert guidance on employment law matters, helping clients steer clear of legal risks and potential disputes.

*It’s important to note that the specific functions may vary depending on the employer of record providers and the client’s requirements. This list provides a general overview of the key functions performed by EORs. For detailed information or specific questions, reaching out to an expert is advised.

When Should Businesses Choose Employer of Record Services

Expanding Internationally Without a Local Entity

For businesses looking to enter new markets without the complexity of establishing a local entity, an EOR simplifies the process by managing employment, payroll, and compliance requirements.

By outsourcing these responsibilities, companies can direct more attention to their core operations. Partnering with an EOR also leads to substantial time and cost savings, as they handle labor-intensive administrative tasks like payroll processing, benefits administration, and legal compliance.

Navigating Complex Employment Laws

When operating in regions with intricate labor laws, an EOR provides valuable support by ensuring full compliance with employment contracts, statutory benefits, tax obligations, and other legal requirements. With regulatory concerns handled, businesses gain the confidence to focus resources on strategic initiatives without fearing unexpected penalties.

Managing Offshore Teams

Many companies lack the insights and resources to effectively manage employees across different countries, and EOR bridges this gap with a deep understanding of local employment practices. By fostering a compliant, positive work environment, EORs help enhance talent engagement and retention, ensuring offshore employees are aligned with the company’s values and objectives.

Avoiding In-House HR Expansion

Companies that prefer not to scale up their internal HR team can leverage an Employer of Record (EOR) to manage essential HR functions, including recruitment, onboarding, payroll, and compliance. By outsourcing these tasks to an EOR, businesses can maintain a lean operational structure without sacrificing the quality or efficiency of HR processes.

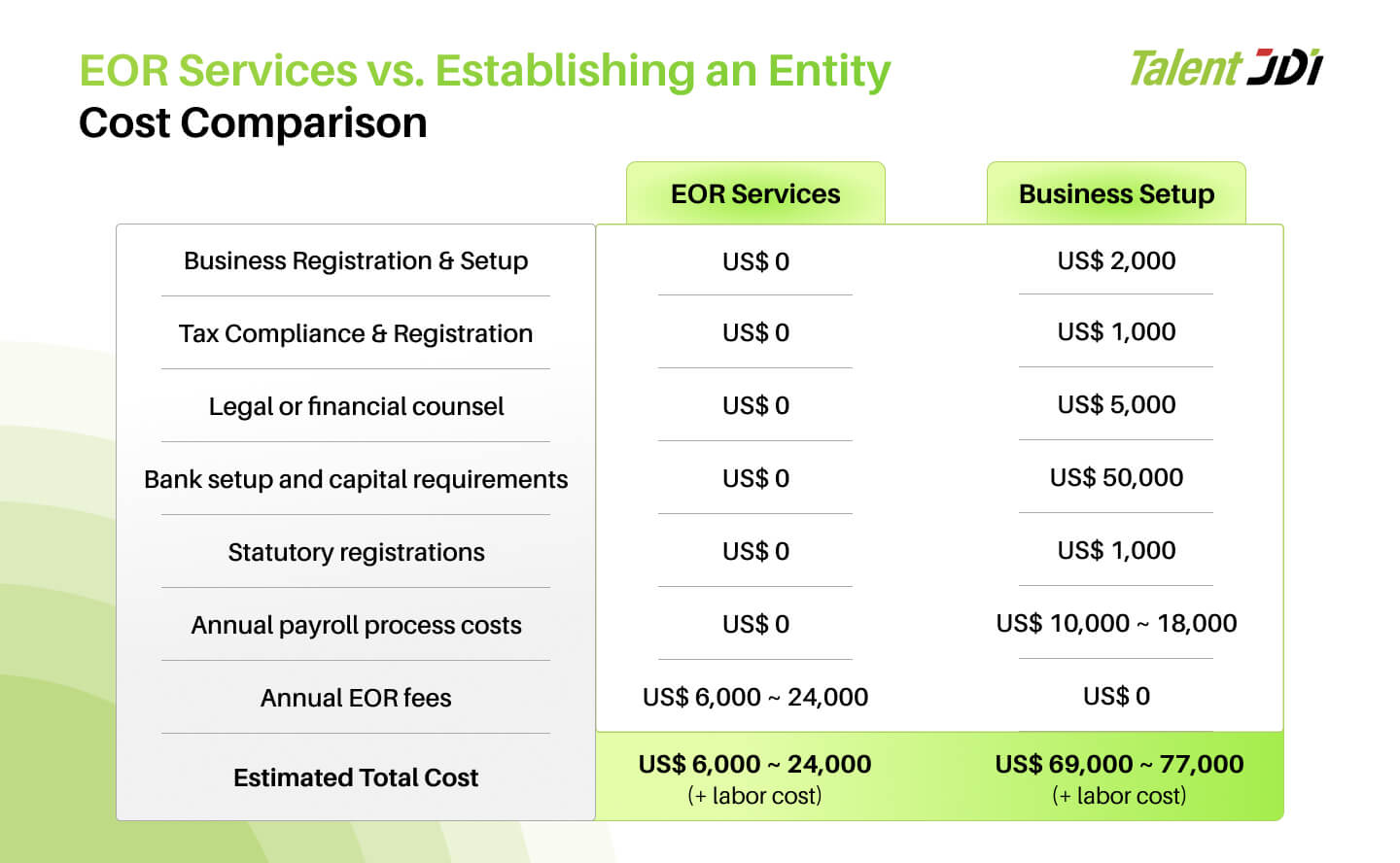

How Much Do Employer Of Record Services Cost

The cost of EOR services can vary based on several factors, including the size of the business, the number of employees, the geographical location, and the specific service packages selected. Still, their pricing model generally falls into three main groups: flat rate, percentage rate, and custom pricing.

Consideration Factors | Flat Rate | Percentage Rate | Custom Pricing |

Suitable for | Large Enterprises | Startups & SMEs | Companies looking for flexibility and to address unique requirements |

Level of Transparency & Cost Control | Higher | Lower | Varies based on business needs |

Better for | Long-term | Short-term | Flexible arrangements based on specific services required |

Flat Rate Model

A flat rate is the most common charging method used by EOR service providers. Businesses will pay a fixed rate per employee (typically ranges between $250 – $500/headcount) that the employer of records manages on their behalf.

While the Flat Rate model may have higher upfront costs, it provides greater transparency for budgeting and is more cost-effective as your team grows. The fixed rate per employee simplifies expense calculations and clearly explains the costs associated with the EOR service.

Percentage Rate Model

The EOR charges their service fee based on client employees’ salaries, resulting in increased costs with promotions or wage raises for their remote developers.

Therefore, it is suitable for startups or SMEs with a small workforce. As the offshore tech team expands, this model can become more costly in the long term.

Custom Pricing Model

The Custom Pricing model, as the name implies, provides businesses with greater flexibility by allowing them to pay for specific services outsourced to the EOR. In contrast to the flat or percentage rate models, firms can customize the service packages based on their specific needs.

Thus, businesses will only pay for what they actually use, making it a suitable choice for companies with existing in-house HR capabilities but still seeking unique HR management customization.

*It is worth noting that these pricing ranges are approximate and may vary by EOR provider and circumstances. For accurate estimates, consult EOR providers directly about your business's needs.

How To Find The Ideal Employer of Record Partner?

1. Define Your Needs and Objectives

Begin by clarifying your specific goals for partnering with an EOR. Consider key factors like the geographic regions you need coverage in, industry expertise, and required services. This initial assessment will help focus your search on EOR providers that align closely with your priorities.

2. Research and Shortlist Reputable Providers

Conduct comprehensive research to identify reputable EOR providers. Look for those with proven experience, strong client reviews, and expertise in your industry or target markets. Review the full range of services they offer—such as payroll management, compliance, benefits administration, and legal support—to ensure they can meet all your requirements.

3. Verify Compliance and Local Expertise

Your EOR partner must have an in-depth understanding of local labor laws, tax regulations, and compliance requirements in the regions where you operate or plan to expand. Evaluate their knowledge of local employment landscapes, as this expertise is key to mitigating risks and ensuring smooth operations.

4. Assess Financial Stability and Reliability

Financial stability is a critical factor in choosing an EOR. Look into the provider’s client portfolio, industry partnerships, and any recognitions or certifications they hold. A financially stable and reliable EOR provides added assurance that they can support your business over the long term.

5. Evaluate Client Support and Communication

The responsiveness and support level of your EOR partner can make a significant difference. Ensure the provider offers prompt, reliable communication and support. Effective, transparent communication is essential to address challenges as they arise and to build a productive working relationship.

6. Review Pricing Transparency

Look for EOR providers that offer transparent, competitive pricing structures, avoiding any hidden costs that could impact your budget. Clear pricing information helps you make a well-informed decision.

7. Ask for Client References

Finally, ask for client references to gain firsthand insights from other businesses that have worked with the EOR. This feedback provides valuable information about the provider’s strengths, areas for improvement, and overall partnership experience, helping you make a confident choice.

Free From Administration and Employment Process Burden With Employer Of Record

Though the concept of Employer of Record (EOR) isn’t new, it has become increasingly popular among companies growing their teams internationally.

An EOR provides seamless support across the entire employment lifecycle—from onboarding to offboarding—handling employee contracts, HR services, and benefits management. By taking on these administrative tasks, an EOR allows businesses to focus on growth while confidently managing a global workforce.

Success stories like ErudiFi demonstrate these benefits. As a leading FinTech company, ErudiFi has lessened the burden and costs of managing its remote team in Vietnam through the partnership with Talent JDI. Learn more about their journey here!