EOR Cost - Employer of Record Pricing Explained

AUTHOR

Talent JDI

READ TIMES

1 minutes

LAST UPDATED

Jan 30, 2026

Many businesses often wonder what determines the EOR cost and how much they’ll actually pay. On average, Employer of Record services can range from $500 to over $2,000 per month, depending on company needs.

In this article, we’ll break down the key aspects of EOR services, providing insights into pricing structures, service fees, and the factors that influence the overall expense.

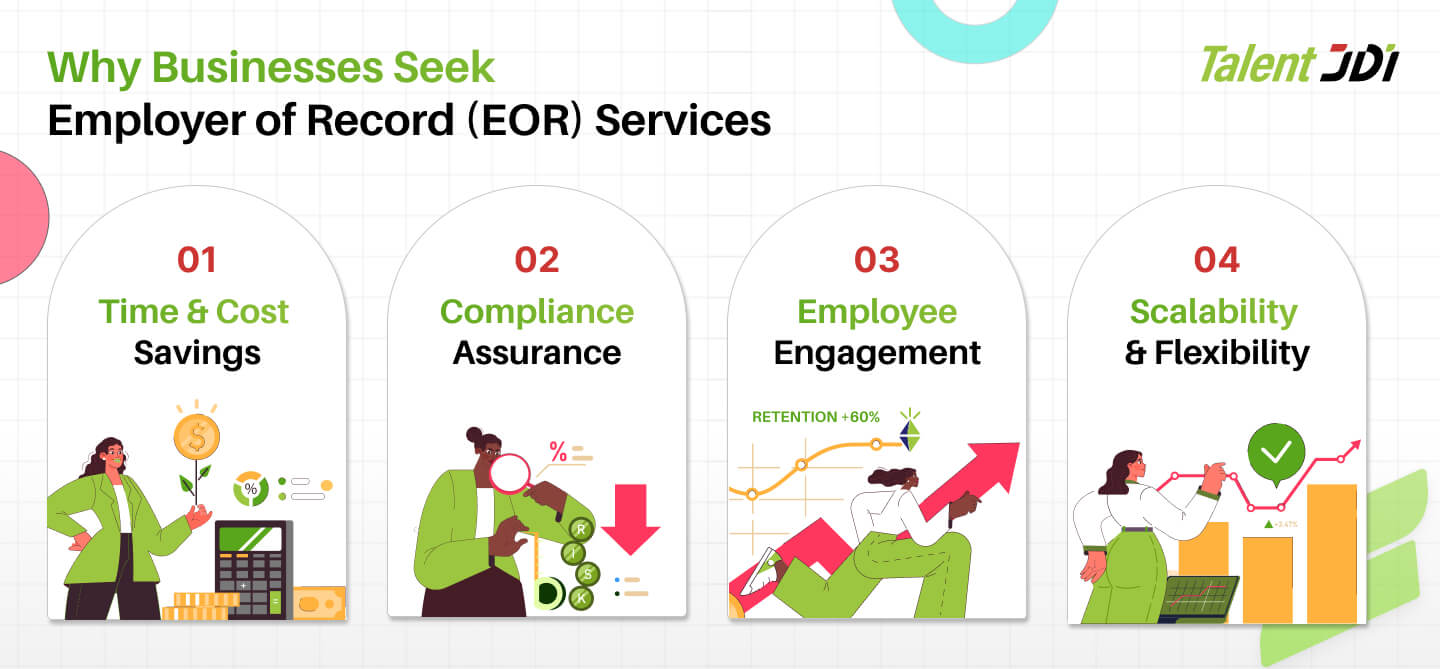

Why Do Businesses Seek Employer of Record (EOR) Services?

An Employer of Record (EOR) acts as the official employer on behalf of an organization, handling all aspects of human resource management, such as payroll processing, tax compliance, benefits administration, legal obligations, and more.

As businesses scale and expand their teams across borders, managing offshore employees and navigating local regulations, compliance issues, and workforce management can quickly become overwhelming. This is where many turn to EOR services for support.

For companies with offshore tech teams or development centers in regions like Vietnam, an EOR solution provides critical benefits such as:

- Time and cost savings by alleviating the burden of HR administration.

- Reduced compliance risks by ensuring effective management of local labor laws and regulations.

- Stronger employee engagement and retention through streamlined operations.

- Scalability and flexibility, enable businesses to quickly adapt their workforce to changing needs and market conditions.

In a nutshell, by partnering with an EOR, organizations can focus on growth while entrusting the complexities of HR management to capable hands.

Interested in different types of HR and Payroll Services? Read on: Employer Of Record Vs. PEO – What’s The Difference?

EOR Cost Breakdown

Most providers charge around $500/month, but pricing can climb to $2,000 for businesses with unique compliance needs. And don’t forget the extras, first-time users will also need to cover onboarding and setup fees.

Here’s a sample pricing sheet* to give you a better idea:

Pricing Components | Estimated Cost** |

| Setup and Onboarding (One-Time Fee) | $500 ~ $2,000 |

| Monthly Service Fees | $500 ~ $2,000 per month |

| Payroll Processing | Included in the monthly fees. |

| Compliance Fees | |

| HR Support & Administrative Costs | |

| Tax Filing and Reporting | |

| Accounting & Annual Audits | |

| Additional fees: special benefits packages, unique compliance requirements, etc. | $1,250 ~ $2,000 |

| Total EOR Cost (with set-up fee) | $1,000 ~ $4,000 |

| Total Monthly EOR Cost | $500 ~ $2,000 |

| Total Monthly EOR Cost (with special requirements) | $1,750 ~ $4,000 |

*For this sample, we will use the Flat Fee per Employee (Monthly) pricing model.

**Disclaimer: This table provides a general overview of key components of EOR cost; actual pricing may vary based on the project scope, service provider, and specific location.

EOR Pricing Models

Based on the cost breakdown above, Employer of Record service providers typically offer different packages to meet the varying needs of clients. In other words, you’ll need to choose the right model based on your business needs, budget, and hiring goals.

Pricing Models | Description | Advantages | Disadvantages | Who would benefit the most |

Percentage of Employee Salary | EOR charges a percentage (typically 10% - 20%) of the employee's salary.

For example:

If your employee earns $8,000/month, the EOR fee ranges from $800 to $1,600. | • Aligns cost with payroll size

• Scales better with your workforce

• Potentially more cost-efficient for smaller teams

• Predictable costs | • Costs increase with higher salaries per employee | 1. Startups and SMEs looking to scale with their payroll expenses.

2. Businesses with a variable workforce, where employee salaries differ significantly. |

Flat Fee per Employee | A fixed fee for every employee, regardless of their salary. | • Predictable expenses

• Simple to manage

• No surprise costs | • Less flexible

• Can be expensive for low-usage scenarios | 1. Organizations with a consistent employee base.

2. Companies seeking simplicity and clarity in budgeting. |

Fixed Pricing Model | A predetermined cost for a specified range of services. | • Consistent expenses

• Better cost management | • Limited customization

• Less responsive when the labor costs or legal requirements shift | 1. Companies with a stable workforce and defined service needs.

2. Companies want to lessen the complexities and uncertainties of variable pricing. |

Custom Pricing | EOR cost is tailored to distinct needs. | • Customized to fit specific requirements

• Can be flexible and accommodating | • Potential for higher costs | 1. Businesses with unique or complex HR requirements or fluctuating service needs.

2. Organizations that have specific industry demands or regulatory requirements. |

Factors Affecting the Employer of Record Cost

EOR costs depend on the level of service a business needs. Since every company has different goals and hiring needs, pricing can vary. What works for one business may not fit another. However, they still follow a general framework with several key factors guiding the determination of the overall cost, including:

A. Number of Employees

The size of the workforce is a key factor in determining EOR costs. It’s also one of the more predictable expenses, as businesses can estimate and adjust costs based on their projected team size.

B. Geographical Location

The location where employees are based has a direct impact on EOR costs. Labor laws, tax structures, and regulations differ significantly across countries and regions. For instance, hiring in a country with stringent compliance requirements or higher statutory benefits may increase the cost of EOR services.

C. Service Scope

Every business has unique operational requirements, and the scope of services requested from an EOR provider directly affects the overall cost. While some organizations may only need basic payroll and compliance support, others might require tailored solutions to address specific needs.

Are There Hidden Costs When Working With An EOR?

The answer depends on the EOR provider you choose. Not all vendors are transparent about pricing—some only advertise the basic monthly fee while claiming to have ‘no hidden costs.’ Unfortunately, many businesses have learned the hard way that this isn’t always the case.

Let’s take a look at the cost factors they might not disclose.

Hidden Costs | What You Should Know |

Setup & Onboarding | Many EORs charge a one-time setup fee covering administrative tasks, compliance checks, employment contracts, and system integration.

Estimated fee: $500 to $2,000 |

Security Deposit | A financial guarantee to cover potential liabilities or payroll obligations, often required upfront.

Estimated fee: Typically 1 to 1.5 months’ worth of service fees. |

Currency Conversions | Additional fees for processing payroll in multiple currencies, often including hidden markups on exchange rates.

Estimated fee: Ranges from 1-5% of the transaction amount. |

Document Processing | Covers legal and compliance paperwork, such as employment contracts, visa applications, and tax filings.

Estimated fee: Vary, usually $100 to $500 per document. |

Employee Benefits Distribution | Some providers may charge extra for managing and distributing employee benefits, such as health insurance and pensions.

Estimated fee: Vary, depending on benefit structure and complexity. |

Offboarding & Termination | Fees for processing employee exits, including severance handling and compliance documentation.

Estimated fee: Vary, depending on the service provider and termination complexity. |

Employee Transfer | Charges for moving an employee from one entity to another.

Estimated fee: Ranges from 10% to 20% of the monthly service fee. |

Be sure to ask your EOR provider about all the fees above to avoid any financial surprises!

Debunking 4 Employer of Record Misconceptions

Misconception #1: EOR Cost Tends to Be Higher Than Setting Up a Local Entity

Fact: Many assume in-house employment is the more affordable option, but the true cost lies in ongoing maintenance. Additionally, the time, energy, and resources required to set up a company can lead to significant budget strain, not to mention the unexpected risks that can arise from market unfamiliarity.

Misconception #2: EOR Solutions Is not Beneficial for Short-term Projects

Fact: EOR solutions are also ideal for short-term projects due to their flexibility and low setup time. Businesses can opt for tailored service packages to stay within budget while reducing administrative overhead

Misconception #3: EOR Solutions Should Only Be Used by Large Companies

Fact: EOR services work well for businesses of all sizes. For startups and SMEs, these solutions provide a streamlined approach to hiring and compliance without requiring a foreign entity setup, while large enterprises benefit from testing new markets or expanding rapidly.

Misconception #4: EOR Limits Level of Control

Fact: The EOR may be the legal employer in the eyes of authorities, yet clients retain full control over daily management. Key decisions on employment terms, work assignments, performance assessments, compensation, and promotions are still entirely in your hands.

Why Businesses Choose Talent JDI EOR Services

Our Employer of Record (EOR) services simplify international hiring, allowing you to expand effortlessly while staying compliant and focused on growth. Thanks to our expertise, we’ve helped 300+ innovative companies scale their tech teams in Vietnam—seamlessly, legally, and without breaking the budget.

With Talent JDI, hiring across borders isn’t just easier—it’s smarter, faster, and built for long-term success. We ensure every aspect, from onboarding to payroll and compliance, is handled with precision, so you can avoid legal pitfalls, optimize costs, and keep your team focused on what truly matters—growth and innovation.

Book a free consultation today! Ask us anything and start building your global workforce with confidence.